The agricultural sector; the primary sector has been the backbone before the industrial revolution. As witnessed by economies, the upholding of the agricultural sector has led to the development of the secondary and tertiary sectors. As for India, agriculture sector growth has been steady with constant support and uplifting by the government.

India ranks 2nd in agricultural output and for approx 54.6% of India’s population, agriculture is the primary source of bread and butter. Over the years, the agriculture sector has effectively transitioned from a subsistence unit to a commercial marketplace. This has paved the way for a basic structured market that has transitioned from barter to currency acceptance. Over time and citing the potential, Fintech has penetrated this sector too with a tailored and customized service stack.

The term Agri Fintech was coined to refer to agricultural technology financing. It enfolds the use of technology to improve the said sector, farming process, value chain financing, farmer reachability, market accessibility and much more with the help of technology.

Earlier banks, and now Fintech have intervened to offer farmers contractual agreements wherein they can avail of value chain farmer financing that consists of operators such as producers, processors, aggregators and traders.

The Importance of Agri Fintech in India

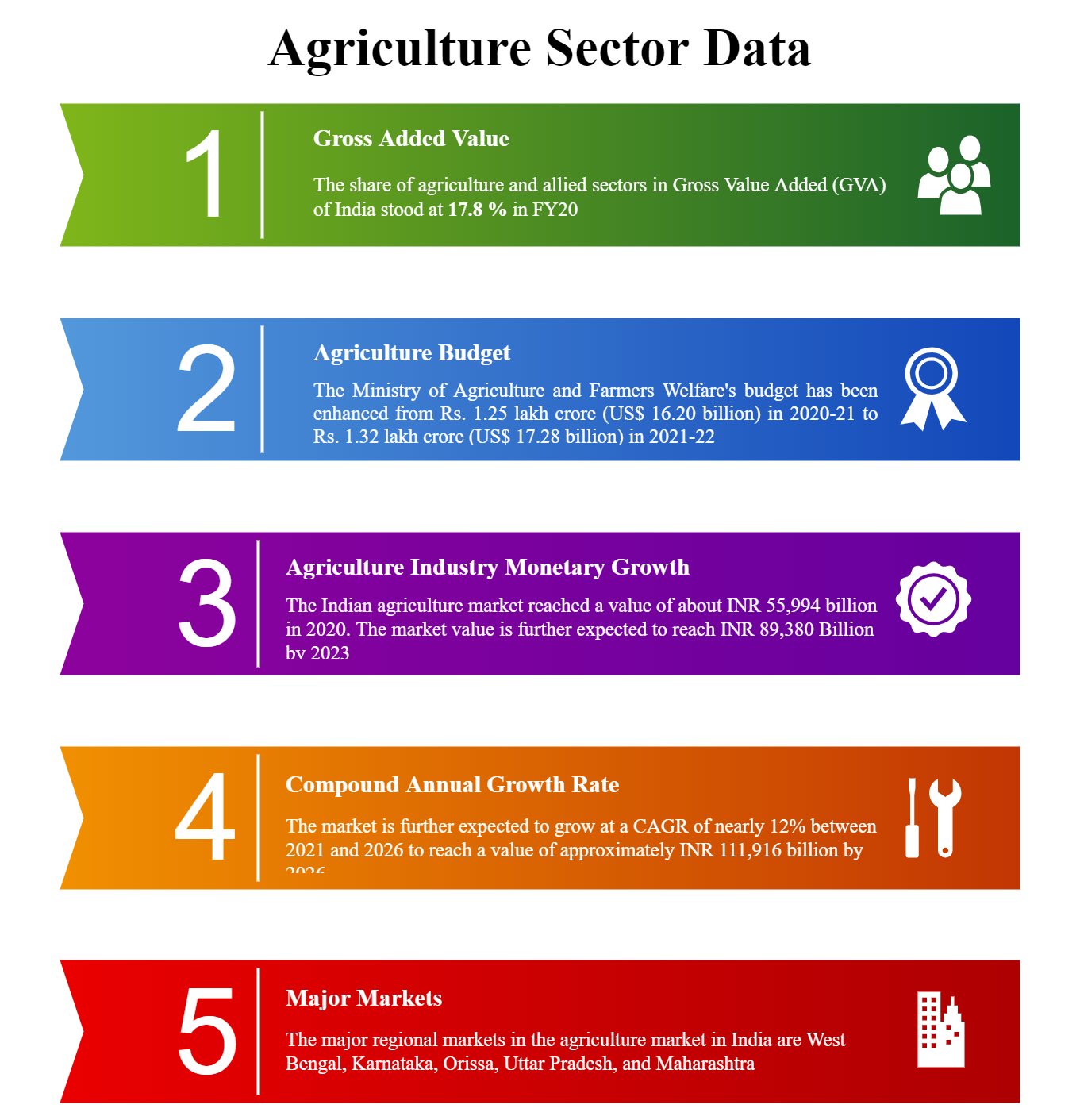

As per data, almost 70% of rural households rely on agriculture for their livelihood. Furthermore, it contributes to 17% of the total GDP and employs over 60% of the population. Despite this, the majority of the farmers have no or limited access to the global market and are forced to sell their produce in the local market at minimal rates.

These gaps have given rise to Agri Fintech which is offering a platform to build the agriculture market with the help of data intervention, market linkages, partnerships, digital blueprints and designs, etc to enable the farmers to scale their business with the help of technology.

With several startups eyeing the segment, many Agri Fintech firms are on the path to building regulated market interconnection, post-harvest schemes, data-centric models and credit-enabling schemes. Furthermore, realizing the potential yet underserved nature of the segment, several startups have already built a platform that offers warehousing services that include credit facilities in partnership with banks.

Several case studies suggest that Fintech is launching NBFC which is trying to digitize the entire agriculture process starting from stock arrival to market supply. By digitizing processes like quality and weight checks, receipt and pledge generation, etc, Fintech is allowing the agriculture sector into financial inclusion by offering them credit against warehouse receipts; a classic example of a blockchain application.

Access to institutional credit is a challenge despite increasing YoY budget allocation under Priority Sector Lending (PSL) for the agriculture sector. As per data, approximately only 30% of farmers have access to institutional credit while 70% are dependent on informal credit means.

The digital layer will allow a transparent end-to-end process thereby eliminating fraudulent activities, unnecessary middlemen and the challenge of securing credit for business growth. Currently, banks are often skeptical to lend to farmers owing to a lack of data, risk analysis, collateral and high transactional cost coupled with loan waivers by state governments to curtail the burden on farmers. This puts lenders in a spot at the time of retrieving the loan amount hence, jeopardizing their balance sheets. Therefore, digitizing means giving farmers access to larger markets and farm economics functioning within the regulatory framework.