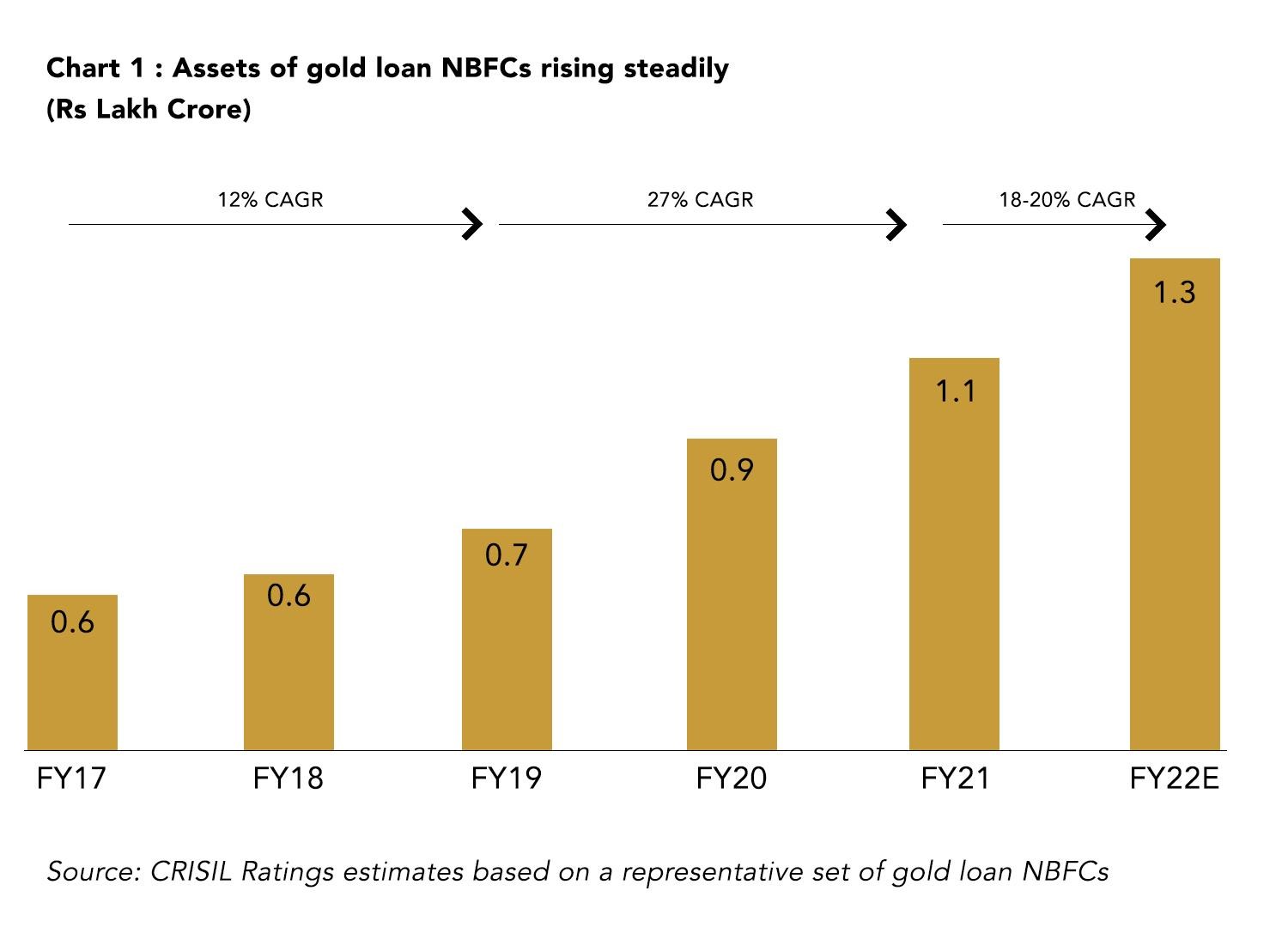

The Assets under Management (AUM) of gold loan NBFC is expected to grow at 12-14% in FY2022-23. According to an estimate, the organized gold loan is currently valued at Rs 4,149 billion and is expected to grow at a 3-year CAGR of 19.5% to reach Rs 7,557 billion by FY2024.

Crisil ratings in the chart above show the growth gold loans have had over the years. To speak of potential growth in the coming years – HDFC Bank recently announced that it has added 51 Gold Loan desks to its branch network in Uttar Pradesh. With the addition of 51 new Gold Loan desks, 170 HDFC bank branches in the state will now be able to offer Gold Loan. It shows the inherent capability gold loan has in mitigating short-term capital challenges.

For banks, the gold loan remains a tool to meet their Priority Sector Lending (PSL) requirements. However, with a growing presence, quicker loan processing capabilities, gold loan schemes of varied tenures, doorstep availability of gold loans, digitally-enabled solutions, etc. gold loan NBFCs have developed a strong market presence.

NBFCs are targeting and specifically catering to mitigate short-term financial needs. Targeting Small and Micro enterprises that run on heavy capital requirements to fund working capital, personal requirements, supplier payments, etc., NBFCs are ensuring MSMEs are included and thrust towards growth.

The pandemic has played a major role in driving acceptance amongst the audience towards the gold loan. The pre-pandemic era saw different sentiments towards gold but with a cash crunch and increasing capital requirements, businesses examined and reconsidered the use of personal assets to the advantage of their short-term business requirements.

From a credit perspective, gold loans are highly secured and generate higher returns with minimal credit risk as a consequence of keeping a close check on Loan-to-Value. Therefore, NBFCs are driven toward introducing and extending a credit against gold.

For NBFCs who place themselves as promoters of inclusivity, gold loans are a means of promoting financial inclusiveness within society. For borrowers who have little to no assets attached to their name, gold comes as shining armor to their rescue in times of dire short-term business needs.

Niyogin Fintech Limited in collaboration with Indiagold is striving to make allowances for MSMEs who visualize growth but are decelerated due to capital requirements that arise because of no assets that could be pledged against the loan.

Here’s a snapshot of Niyogin + Indiagold loan

- Loan Amount – Up to 75% of the market value of the gold pledged

- Interest Rate – 0.85% per month

- Processing Fees – Nil

- Service at doorstep

- Quick release guarantee

Besides the fact that gold loans allow individuals and businesses to get instant funds, it also has no prepayment or late payment penalties. Its easy application process coupled with the security of the asset adds to the list of conveniences gold loans could be for society at large.